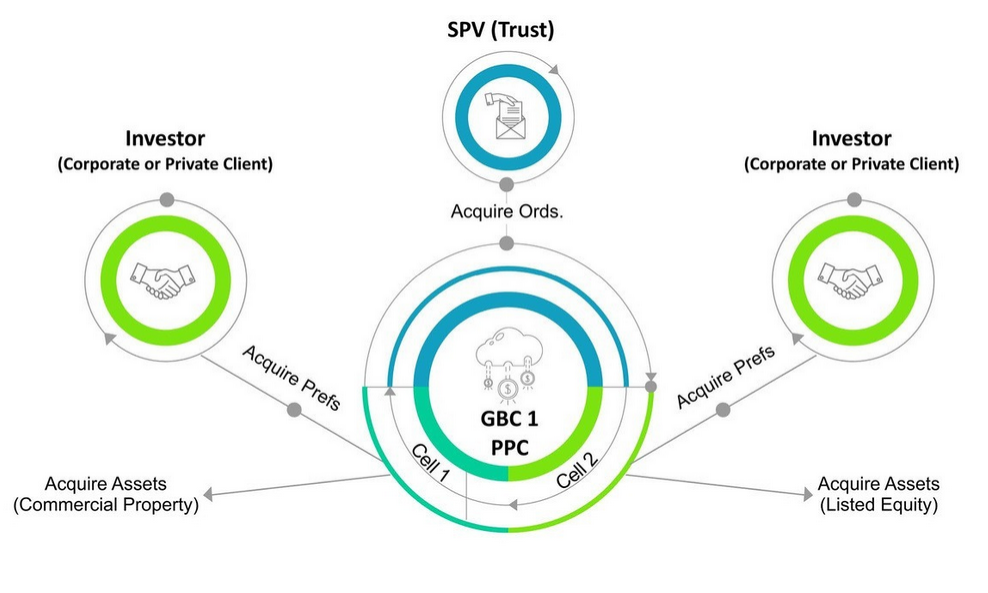

Protected Cell Company (PCC)

A PCC is a corporate structure in which a single legal entity is comprised of a core and several non-core cells, and the assets and liabilities of each non-core cell are legally protected from the failure of another non-core cell.

How BTG can assist

- Advice on structuring

- Formation of the company

- Provision of Registered Office,

resident directors, and Company

Secretary - Back-office administration and

accounting services - Assistance with opening and

administration of local bank account - Regulatory compliance

How a Protected Cell Company works

Key Features

What is a Protected Cell Company (PCC)?

A PCC is a single legal entity that achieves cost efficiency while allowing legal segregation and protection of assets and liabilities for each cell.

Are there any capital requirements for a PCC?

There are no minimum capital requirements imposed for the PCC or its cells, except in cases of insurance or funds licenses.

How many cells can be created within a PCC?

A PCC can have an unlimited number of cells, with each cell having its own name or designation.

How does a PCC protect creditors?

The PCC Act includes provisions to protect creditors, ensuring that liabilities of one cell do not impact others.

Can a PCC accommodate leverage facilities?

Yes, the structure allows for leverage facilities within each cell.

How are assets and liabilities managed within a PCC?

The cellular assets attributed to a cell can only be affected by the liabilities arising from transactions related to that specific cell.

What types of shares does a PCC issue?

A PCC typically issues two classes of shares:

-

Core shares – Carry voting and control rights

-

Cell shares – Issued for each individual cell but do not carry voting or control rights

How are dividends managed within a PCC?

-

Dividends are payable only by reference to the profits of each individual cell.

-

A PCC is taxed as a single entity at the core level, while each cell is taxed individually.

-

Dividends may also be paid only to shareholders of a specific cell, based on that cell’s assets and liabilities.

Can the rights of shares differ between cells?

Yes, the rights of shares for one cell may differ from the rights of another cell.

Is an annual audit required for a PCC?

Yes, a PCC is required to undergo an annual audit.

Main Contact

Pravesh Heeroo

Business Development Specialist

Meet the rest of our Team

Other Services

Discretionary Trust

A Discretionary Trust in Mauritius is a flexible type of Trust mainly used in wealth protection and tax planning. It is established by a settlor who settles assets on trust to achieve the objects of the trust.

Global Business License Company (GBL)

A Global Business License Company is a resident corporation which proposes to conduct business principally outside of Mauritius and is licenced by the Financial Services Commission.

Domestic Company

A domestic company in Mauritius can operate with both residents and non-residents. However, if it is controlled by a non-citizen and conducts business mainly outside Mauritius, it must obtain a Global Business License.

Suitable for use for:

-

Asset Holding

- Structured finance businesses

- Insurance Business

- External Pension Schemes

- Collective Investment Schemes

- Specialised Collective Investment Schemes and Close-end funds