Mauritius Foundation

A Foundation is a legal entity formed for such purposes as may be provided in its charter, including the carrying out of the objects specified in it.

How BTG can assist

- Advice on structuring

- Drafting of Foundation Charter and other related documents

- Establishment of the Foundation

- General Administration of the Foundation

- Provision of Registered Office

- Provision of resident Council Member

- Provision of Qualified Secretary

- Assistance with opening and administration of bank account

- Regulatory compliance

- Ensure records including account records are in place

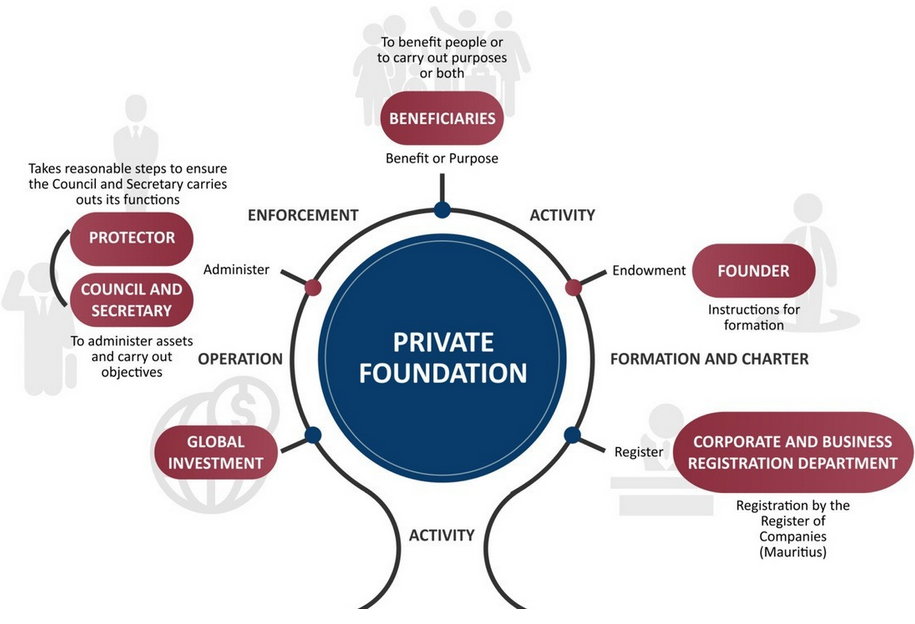

How a Mauritus Foundation Works

Key Features

What are the key administrative requirements for a Foundation in Mauritius?

-

Must have a Qualified Secretary in Mauritius

-

Must have a Registered Office in Mauritius

-

Must keep records, including accounting records, at its Registered Office address in Mauritius

Who has access to Foundation records?

-

The Council is obliged to provide Foundation information to the beneficiaries

-

Third parties can only access records with permission from the Foundation Secretary

-

Confidentiality requirements are enshrined in law

When and how can a Foundation be established?

A Foundation can be established during the founder’s lifetime or by means of a will.

What are the objects of a Foundation?

The objects of a Foundation may be:

-

Charitable or non-charitable, or both

-

For the benefit of a person or a class of persons

-

To carry out a specified purpose, or both

Does a Foundation need to be registered in Mauritius?

Yes, a Foundation must be registered with the Registrar in Mauritius to have a separate legal personality.

Can a Foundation engage in business activities?

-

Must have a registered office in Mauritius

-

Must keep records, including accounting records, in Mauritius

-

Third parties can only access records with permission from the Trustee and Protector (if any)

-

Confidentiality requirements are enshrined in law

How is a Foundation taxed in Mauritius?

If the central management and control is outside Mauritius, the Foundation is treated as non-resident for tax purposes and taxed only on Mauritius-sourced income.

A resident Foundation in Mauritius is taxed on its worldwide income.

What are the requirements for a Foundation's governing body?

-

A Foundation must have a Council

-

The Council must have at least one member resident in Mauritius

Can the Founder also be a beneficiary?

Yes, the Founder may be a beneficiary of the Foundation and does not need to be a resident of Mauritius.

Main Contact

Pravesh Heeroo

Business Development Specialist

Meet the rest of our Team

Other Services

Discretionary Trust

A Discretionary Trust in Mauritius is a flexible type of Trust mainly used in wealth protection and tax planning. It is established by a settlor who settles assets on trust to achieve the objects of the trust.

Global Business License Company (GBL)

A Global Business License Company is a resident corporation which proposes to conduct business principally outside of Mauritius and is licenced by the Financial Services Commission.

Domestic Company

A domestic company in Mauritius can operate with both residents and non-residents. However, if it is controlled by a non-citizen and conducts business mainly outside Mauritius, it must obtain a Global Business License.

Suitable for use for:

- Investment Holding to own property, share and bond portfolios, aircraft/ships, and other growth assets

- Family Office holding vehicle to own family office companies and investments

- Estate and succession planning

- Special purpose vehicle to perform certain actions