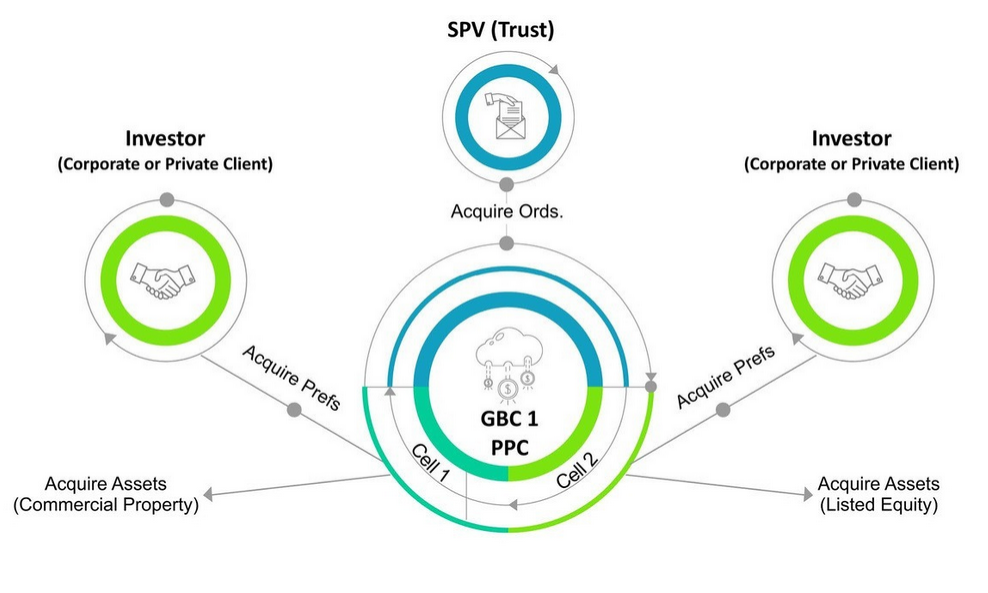

Protected Cell

Company (PCC)

A PCC is a corporate structure in which

a single legal entity is comprised of a

core and several non-core cells, and the

assets and liabilities of each non-core

cell are legally protected from the

failure of another non-core cell.

Key Features

- Single legal entity which achieves cost efficiency

- Legal segregation and protection of assets and liabilities for each cell

- No minimum capital requirements are imposed for the PCC of the cells, except in the case of insurance/funds licences

- Unlimited number of cells may be set up with each cell having its own name or designation

- Provisions for the protection of creditors under the PCC Act

- Allows for accommodation of leverage facilities within the cell

How BTG can assist

- Advice on structuring

- Formation of the company

- Provision of Registered Office,

resident directors, and Company

Secretary - Back-office administration and

accounting services - Assistance with opening and

administration of local bank account - Regulatory compliance

- The cellular assets attributed to a cell will only be affected by the liability of the company arising from transaction attributable to that cell

- Normally issues two classes of shares – shares to the Core which carry voting and control rights, and shares issued for each Cell which do not carry any rights as to voting and control

- Dividends are payable only by reference to the profits made by each individual Cell, the PCC is taxed as a single entity at core level whilst each cell is taxed individually

- May also pay dividends with respect to the shareholders of a specific cell by reference only to the assets and liabilities attributable to that cell

- Rights of shares of one cell may differ from rights of another cell

- Require an annual audit

How a Protected Cell Company

works

Suitable for use for:

- Asset Holding

- Structured finance businesses

- Insurance Business

- External Pension Schemes

- Collective Investment Schemes

- Specialised Collective Investment Schemes and Close-end funds